Since the rollout of the Goods and Services Tax (GST) in July 2017, India has gradually shifted toward a unified indirect taxation system. While various revisions have taken place over the years—mostly involving adjustments to tax rates for specific goods or services—a major structural overhaul now seems imminent.

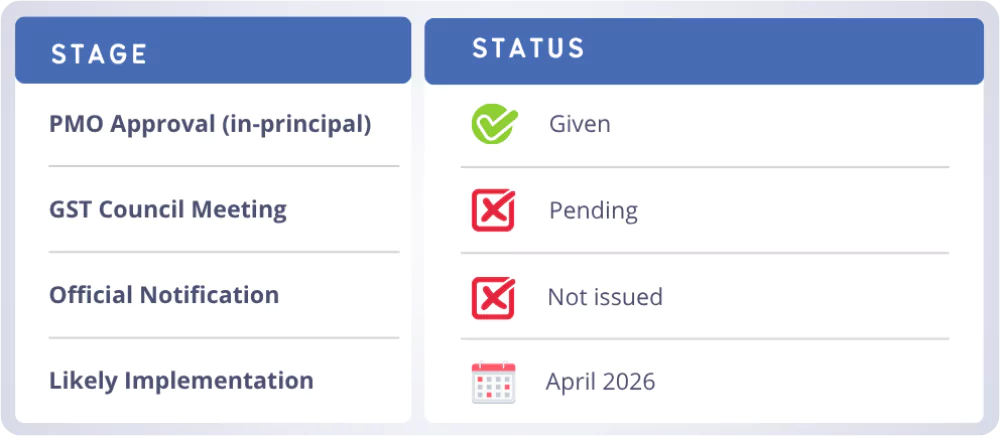

In mid-2025, the Prime Minister’s Office (PMO) gave in-principle approval to a proposal that could eliminate the 12% GST slab. However, it’s essential to note that this change has not yet been officially implemented. It will still need to be cleared by the GST Council, likely in its next meeting following the Monsoon Session of Parliament.

This blog breaks down what this proposed change means, why it's being considered, its possible impact, and what businesses and consumers should expect if the change is adopted in FY 2026–27.

A Quick Refresher: What Is GST?

GST (Goods and Services Tax) is a unified indirect tax that replaced a complex structure of central and state-level taxes, including VAT, service tax, excise duty, and more. The goal was to create "One Nation, One Tax", making taxation more efficient and reducing the cascading effect of multiple taxes.

Currently, GST has five main tax slabs:

There are also special rates, such as:

- 0.25% – Precious stones

- 3% – Gold and jewelry

What’s the Proposed Change?

The government is proposing a major simplification of the GST structure by removing the 12% slab entirely. This would lead to several changes aimed at creating a more streamlined system:

- Right now, GST has five main rates: 0%, 5%, 12%, 18%, and 28%. There are also two special low rates for things like gold (0.25% and 3%).

- Approximately 21% of all items are currently taxed at a rate of 5%. The 12% slab covers 19% of items, while the 18% rate covers the largest chunk—44%. Only 3% of items fall under the highest 28% rate.

- The idea is to remove the 12% slab and shift those items to either 5% (cheaper) or 18% (costlier), depending on whether they are essential or luxury items.

- Some expensive and harmful items—such as cigarettes and cars—already have an extra tax called a compensation cess, in addition to the 28% GST.

- This additional tax was introduced to help states recover from losses when the GST was first implemented. It was supposed to end in 2022, but now it has been extended until March 2026 to repay money borrowed during the COVID crisis.

- A group of ministers has been established to determine how the additional funds collected from this cess will be utilized in the future.

Why Remove the 12% Slab?

According to reports and expert commentary, several reasons support this shift:

- Overlapping classifications: Some goods straddle multiple slabs, leading to disputes and confusion (e.g., caramel popcorn vs. salted popcorn).

- Ease of doing business: Simplified slabs mean easier compliance, faster tax filing, and fewer legal complications.

- Revenue neutrality: By reassigning 12% goods up or down, the government aims to maintain balanced tax collection.

- Policy direction: A streamlined tax system is seen as more investor- and trade-friendly, aligning India with global best practices.

Which Goods Could Be Affected?

The exact reassignment of goods has not been finalized, but based on current use patterns and price sensitivity, experts believe:

May move to 5% GST:

- Ghee, butter

- Processed snacks (namkeen, chips)

- Fruit juices

- Umbrellas

- Low-cost household items

May move to 18% GST:

- Mobile phone components

- Readymade garments above ₹1,000

- Household electronics

- Fertilizers (though sensitive and might stay lower)

- Premium processed foods and beverages

Note: These shifts are not yet confirmed. The GST Council will decide the final categorization.

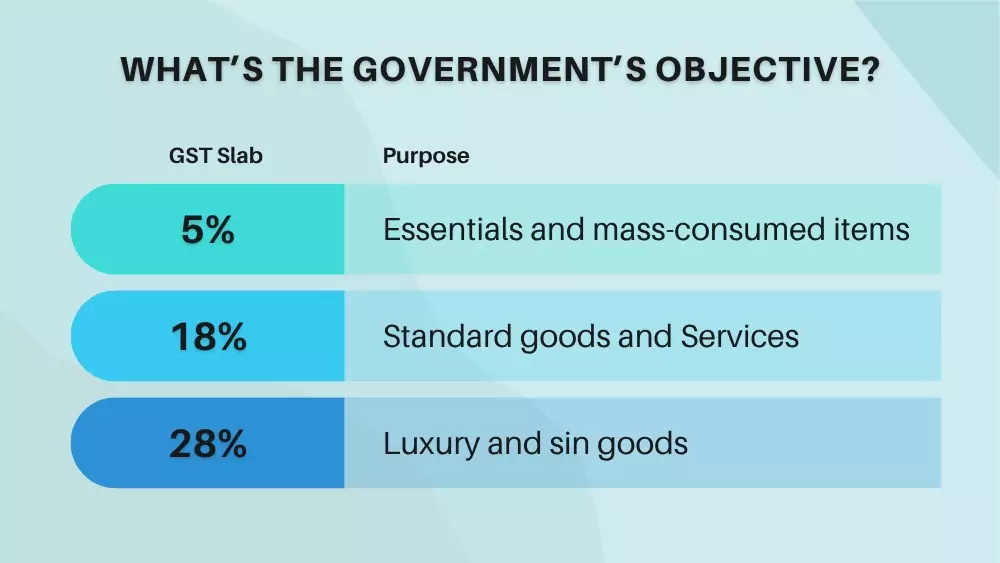

What’s the Government’s Objective?

The long-term goal appears to be a 3-slab GST structure:

Special rates (0%, 0.25%, 3%) and applicable cess will remain for select items (e.g., tobacco, luxury cars).

This system is expected to:

- Reduce tax-related litigation

- Lower the compliance burden on MSMEs

- Create a more predictable tax environment.

- Make GST more compatible with international trade treaties

What About the GST Compensation Cess?

The Compensation Cess was introduced to help states recover from a revenue shortfall following the implementation of GST. During the COVID-19 pandemic, states borrowed around ₹2.7 lakh crore, and this cess helped cover the repayments.

This cess is currently valid until March 31, 2026. It remains to be seen whether the government will extend or phase out the program.

Who Will Be Impacted—and How?

Now, let'see who and how it will be impacted to the users or individuals:

Consumers

- Some goods may get cheaper if moved to the 5% bracket.

- Others may become more expensive if the rate is increased to 18%.

- Overall impact will depend on your consumption pattern.

Businesses and MSMEs

- Simpler tax categorization = fewer disputes

- Easier to claim Input Tax Credit (ITC)

- Streamlined invoicing and returns

- Especially helpful for small traders and service providers

State Governments

- May resist the proposal if they fear revenue loss, especially if high-selling goods move to lower brackets.

- It could become a political issue in the upcoming state elections.

- States may also raise concerns about inflationary pressure if consumer goods move to higher slabs.

Political and Economic Considerations

- The GST Council, chaired by the Union Finance Minister and comprising all state finance ministers, will take the final decision via a voting process.

- Changing the 12% slab is seen as politically less risky than adjusting the 5% or 18% rates, which affect either low-income populations or government revenue.

- Any increase in tax on necessities could attract public backlash or hurt electoral outcomes.

What’s the Timeline?

Until the GST Council approves the change and officially notifies it, the existing tax structure remains unchanged.

Final Thoughts

The proposed removal of the 12% GST slab could be a game-changer for India’s tax landscape. While it aims to simplify and modernize GST, the change comes with both opportunities and challenges.

If passed, it could:

- Simplify tax compliance

- Improve the ease of doing business.

- Lead to short-term inflation or revenue disruption.

However, for now, the move remains a proposal, pending the GST Council's approval. Stakeholders should closely monitor updates and prepare for potential changes starting in FY 2026–27.