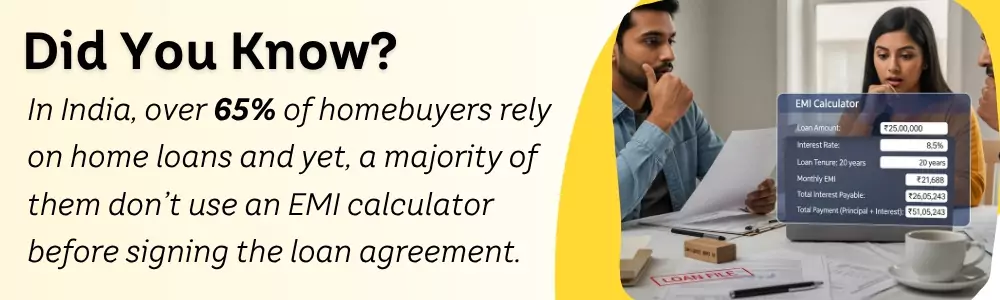

Planning to buy a home? Before you sign on the dotted line, it's crucial to know what your monthly loan payments will look like.

A home loan EMI calculator helps you estimate your EMI, total interest, and overall repayment—instantly. It’s a quick, accurate way to plan your finances and avoid surprises.

Whether you're comparing lenders or adjusting your loan tenure, this tool gives you clarity in seconds. It's your first step to making a smart, stress-free home buying decision. Let’s see how it works.

Your 60-Second Guide to Using the Home Loan EMI Calculator

Let’s break it down with a real-world example—just like what you’ll see on HR HUB’s Home Loan EMI calculator:

Step 1: Enter Your Loan Amount

This is the principal—the amount you want to borrow. The higher this number, the higher your EMI will be. But it’s not just about how much you need; it’s also about how much you should responsibly borrow.

Pro Tip: Consider your existing liabilities and monthly savings while finalizing this number.

Say you plan to borrow ₹25,00,000. Plug that in.

Step 2: Choose Your Loan Tenure

This defines how long you plan to repay the loan, usually between 10 and 30 years.

- Shorter tenure = higher EMI but lower total interest

- Longer tenure = lower EMI but higher total interest

It’s a delicate trade-off, and using a home EMI calculator can help you visualize how this choice plays out.

Let’s say 20 years feels manageable. Select 20.

Step 3: Add the Interest Rate

This is where many people often get caught off guard. Even a 1% difference in interest rate can mean lakhs in additional repayment.

Let’s say you borrow ₹25 lakhs at 15% for 20 years. Your monthly EMI? ₹32,920 Your total repayment? ₹79,00,737 That includes ₹54,00,737 in interest alone!

A slight tweak in interest rate—and you can shave off significant interest payments.

Step 4: See Instant Results

And just like that, you get:

- Monthly EMI: ₹32,920

- Principal Amount: ₹25,00,000

- Interest Amount: ₹54,00,737

- Total Payable: ₹79,00,737

Plus, you’ll get a neat pie chart showing how much of your total payment goes toward the principal and how much to interest.

No guessing. No what-ifs. Just clean, clear numbers—exactly what a solid financial decision needs.

Why We Recommend HR HUB’s Home Loan EMI Calculator

Sure, there are dozens of calculators out there—but not all of them get the experience right.

That’s why we strongly recommend HR HUB’s Home Loan EMI Calculator. It’s built with simplicity in mind, but doesn’t skip on the details. Whether you’re a first-time buyer or a second-home investor, this tool makes the math painless—and the decision easier.

Clean design, real-time results, and no sign-ups or jargon. Just the way modern finance tools should work.

Where Smart Home Buying Begins

Before the site visit. Before the down payment. Before the housewarming party.

Start with the EMI.

Because that’s where your homeownership journey begins—with a number that lives with you every month for years to come, a home loan EMI calculator gives you power: the power to plan, compare, and commit with confidence.

And if you’re ready to do that now, we suggest starting here: Use HR HUB’s EMI Calculator Today.

Your dream home might come with a price tag, but your peace of mind? That’s free—when you plan smart.

You can explore more such calculators at HR HUB: https://www.hrhub.app/calculators