Planning to withdraw your PF soon?

Not sure how much you’re eligible for—or what the new rules are?

You’re not alone. In 2025, the Indian Government introduced new EPF withdrawal rules to simplify the process for salaried employees nationwide. From retirement to emergencies, the updated guidelines aim to make your EPF withdrawals faster, clearer, and fully compliant.

Want to know your exact EPF amount before you begin? Try the HR HUB EPF Calculator—a quick and reliable way to estimate your total balance, contributions, and interest.

Step-by-Step Process to Claim EPF Online in 2025

There is no longer a need to rush to the post office or HR to make an EPF withdrawal, as it is now completely digital. Here's how:

Step 1: Verify KYC and UAN activation

Make sure your UAN (Universal Account Number) is:

- Activated

- Linked with Aadhaar

- Linked with Bank Account & PAN

- KYC Verified

Visit https://unifiedportal-mem.epfindia.gov.in/ to log in.

Step 2: Log in to the EPFO Member Portal

Use your UAN and password.

Step 3: Go to “Online Services” > “Claim (Form-31, 19, 10C)”

Once on the dashboard:

- Select "Online Services."

- Choose “Claim” from the dropdown.

Step 4: Verify Member Details

Ensure that your bank account and Aadhaar details match and are KYC-verified.

Step 5: Enter the last four digits of your bank account number.

EPFO uses a bank OTP to confirm your identity.

Step 6: Choose Claim Type

You’ll see options like:

- PF Final Settlement (Form 19)

- Pension Withdrawal (Form 10C)

- PF Advance/Partial Withdrawal (Form 31)

Choose based on your requirement.

Step 7: Submit Claim and Wait for Approval

You will receive an SMS acknowledgment after submitting. Claims typically get processed within 7–15 working days.

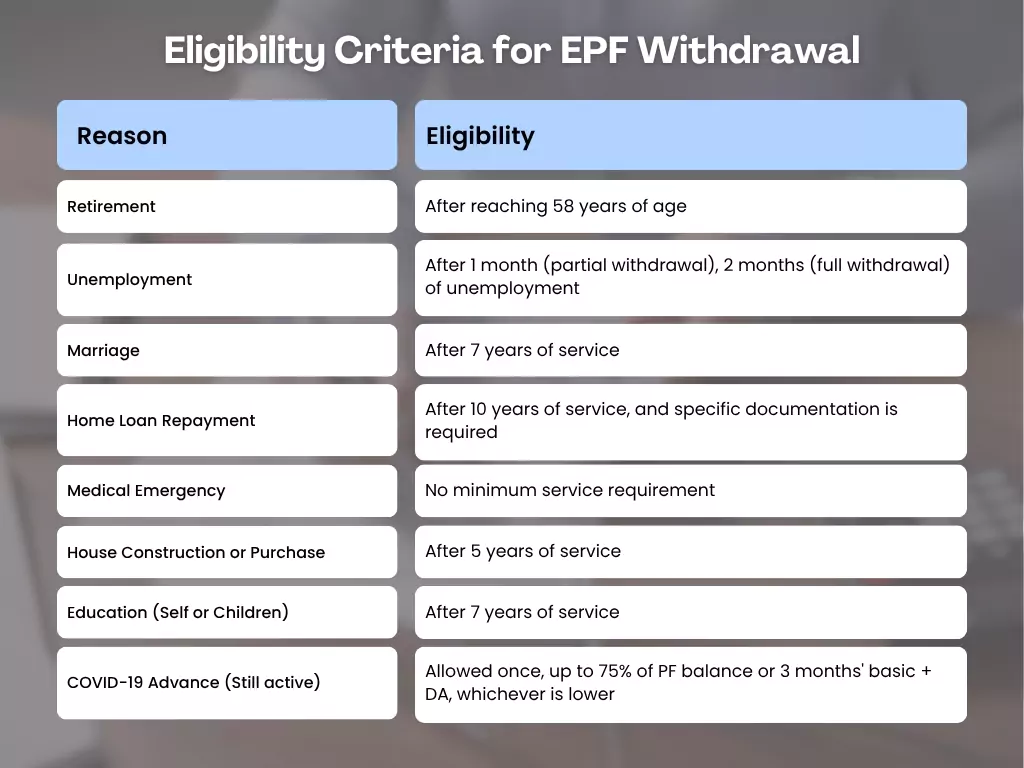

Eligibility Criteria for EPF Withdrawal in 2025

Before submitting a claim, you must meet one of the following conditions:

Note: You can’t withdraw the full balance if you're still employed, except under specific rules (like illness or partial advances).

What do You Need for Withdrawal?

- The Universal Account Number, or UAN, needs to be active and in compliance with KYC.

- The bank account must be linked.

- Aadhaar and PAN must be verified on the EPFO portal.l

- You can apply via:

When Can You NOT Withdraw PF Online?

Despite the digital push, a few cases still need manual intervention:

- Mismatch in name/date of birth

- Bank account closure or wrong IFSC

- The employer is not updating the exit date in the system.

- Non-KYC verified account

These require physical submission of Form 19/10C or employer involvement.

Important Points to Remember in 2025

- One PF, Multiple Jobs: Always transfer your PF when switching jobs to keep it centralized and ensure continuous service.

- Aadhaar-Based Seeding: All digital claims rely on Aadhaar-based e-KYC—manual claims are now rare.

- Track Claim: Use the EPFO portal or the UMANG app to check the real-time status.

- Bank Details Mismatch: Most delays occur due to incorrect or unverified bank info—double-check!

- Joint Declaration Forms: For any correction in name, date of birth, or exit date, a joint declaration with the employer is still required.

Let’s Call It What It Is: Financial Freedom, Unlocked

Employees today are more knowledgeable than ever about managing their PF, thanks to resources like EPF calculators and growing financial awareness. In 2025, it’s no longer just about “claiming your EPF”—it’s about claiming control over your finances, your timeline, and your future.

And if you’re an HR professional, there’s even more on the line.

That’s where platforms like HR HUB step in. From automating PF submissions, KYC management, withdrawal alerts, and employee tax declarations, HR HUB streamlines processes for both employees and HR teams. It's not just software; it's the engine of smart HR decisions, backed by compliance, efficiency, and trust.

So the next time someone tells you PF withdrawal is confusing, you’ll have just one answer: “Not anymore.”