The Union Budget 2026 may not have brought sweeping tax reforms or populist giveaways, but behind its calm tone lies a clear message: India is getting ready for the next phase of its economic journey.

The Budget 2026 highlights:

- Strengthening compliance

- Enabling faster business growth

- Creating future-ready job opportunities

- Supporting the digital and innovation economy

And the best part? Every segment of the Indian population has something relevant here. Whether you're a startup founder, salaried professional, active investor, or student, this guide breaks down the Budget 2026 into simple language you can actually understand.

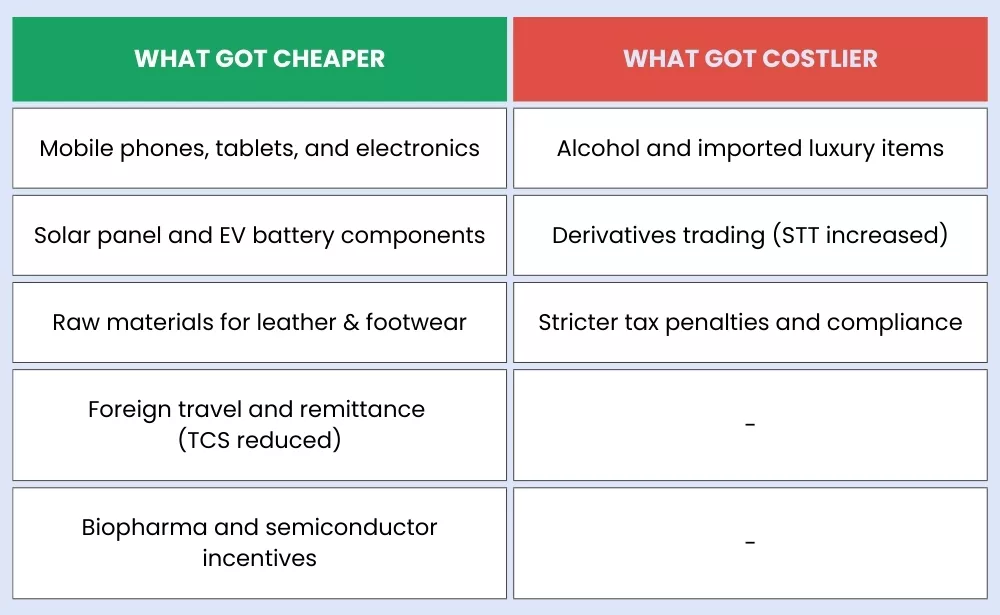

What Budget 2026 Means for Entrepreneurs, Startups, and MSMEs

What’s Cheaper: Entrepreneurs and startup founders have something to look forward to with this budget. By focusing on manufacturing and Make in India, the government has reduced customs duties on several essential components used in business operations.

- Mobile phones, tablets, and consumer electronics: Customs duties on key components were reduced, making it cheaper for startups dealing in hardware or providing tech-enabled services to procure devices.

- Solar panels and EV batteries: With reduced import duties on components, businesses in the clean energy and mobility space will see lower input costs.

- Raw materials for footwear and leather: Duty-free import on select inputs will benefit MSMEs in the fashion, export, and retail manufacturing sectors.

- Lower TCS on overseas travel: The reduction in Tax Collected at Source (TCS) for foreign remittances and travel makes it more affordable for startup founders and MSMEs to participate in international trade fairs or business conferences.

- Biopharma and semiconductor industry incentives: The new schemes announced in the budget, such as the Biopharma Shakti Yojana and Semiconductor Mission 2.0, are designed to encourage R&D and domestic production, directly benefiting innovation-driven startups.

What’s Costlier:While the incentives are notable, there are a few areas where entrepreneurs need to stay cautious.

- Alcohol and luxury imports: Businesses in premium hospitality, event management, or F&B that rely on imported liquor or luxury goods may face higher procurement costs.

- Securities Transaction Tax (STT) on derivatives: Entrepreneurs managing company treasury or investing in the derivatives market will face higher trading costs.

- Stricter tax penalties: With increased penalties for false reporting and tax evasion, compliance requirements are now tighter. Startups must ensure meticulous accounting and documentation to avoid penalties.

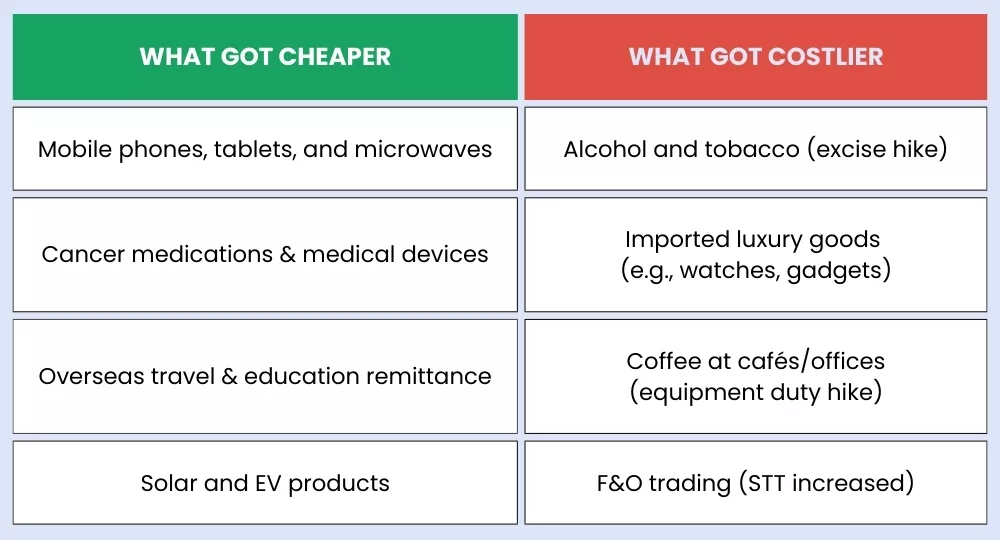

What Budget 2026 Brings for Salaried Employees & the Middle Class

What’s Cheaper: For the salaried segment, the budget offers relief in key areas of consumer spending and healthcare, helping ease the cost of living indirectly.

- Consumer electronics: Mobile phones, microwaves, and tablets have become cheaper due to reduced customs duties, providing better access to technology.

- Healthcare essentials: Customs duties were slashed on certain cancer medications and medical devices, bringing down healthcare expenses for families.

- Foreign travel and remittances: A reduction in TCS on foreign remittances (especially for travel or education) makes international trips more affordable for middle-income families.

- Solar and electric solutions: Tax cuts on solar panel inputs and EV-related imports make it cheaper to adopt sustainable options for personal use.

What’s Costlier: Despite the benefits, a few lifestyle and financial decisions require re-evaluation.

- Alcohol and tobacco: The increase in excise duty will make alcohol and cigarettes more expensive, hitting personal lifestyle expenses.

- Imported luxury goods: Costlier due to higher customs duties, including watches, branded accessories, and electronics.

- Coffee at workplaces or cafes: The withdrawal of duty concessions on imported coffee brewing machines is expected to raise prices at outlets.

- Higher trading taxes: If salaried individuals invest in F&O (Futures and Options), the increased STT directly affects profitability.

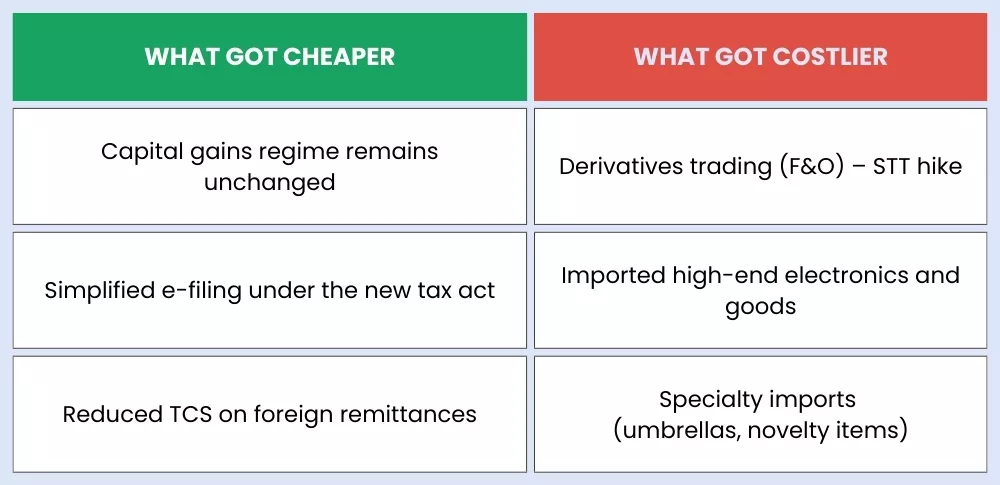

What Budget 2026 Means for Investors & Traders

What’s Cheaper: This year’s budget remained stable on the capital gains tax front and brought in clarity through the proposed New Income Tax Act.

- Stable capital gains regime: No new taxes were imposed on capital gains, offering relief to long-term equity investors.

- Improved compliance tools: The transition to digitized, simplified tax filing systems will benefit high-frequency investors.

- Reduced TCS on international remittances: Useful for those investing in international platforms or transferring funds overseas.

What’s Costlier: Some financial tools and instruments are expected to attract higher transactional costs, especially for active traders.

- Futures & Options (F&O) trading: The Securities Transaction Tax (STT) on derivatives has been increased, directly impacting the cost of high-frequency or margin trading.

- Imported goods and high-end electronics: Traders dealing in international goods or the B2B luxury segment may see thinner margins due to higher customs duties.

- Umbrella and parts imports: Specific duties were introduced, affecting businesses dealing in niche or novelty items.

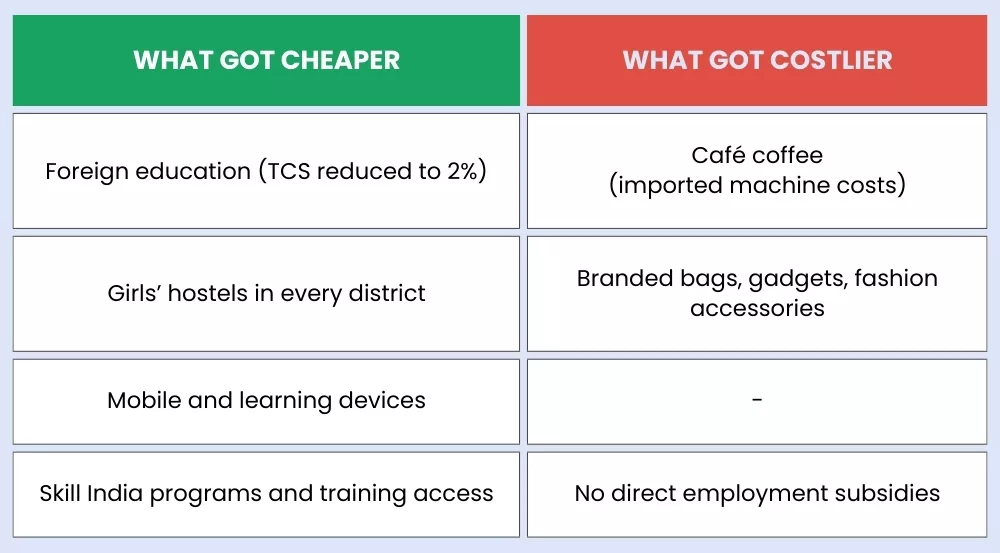

What Students, Job Seekers, and Fresh Graduates Should Know

What’s Cheaper: The government has shown intent to support youth, students, and those seeking employment, especially in education and digital access.

- Overseas education expenses: The TCS on foreign education remittances has been reduced from 20% to 2%, making international education more affordable.

- Girls’ hostels and infrastructure: The announcement to establish girls’ hostels in every district is a major step toward improving access to education in rural and semi-urban areas.

- Cheaper mobile and learning devices: Reduced duties on electronics will make it easier for students to access essential study tools.

- Skill development schemes: New allocations to Skill India and employment-oriented training centers will support job seekers.

What’s Costlier: While most student-related areas saw relief, a few daily expenses could see an uptick.

- Café visits and vending: Imported coffee machines will be costlier, potentially raising prices in college canteens and public food outlets.

- Lifestyle imports: Branded bags, gadgets, and fashion accessories will become more expensive due to higher import duties.

- No direct job incentives: While skilling programs are being funded, there are no large-scale direct job generation schemes or employment subsidies in this budget cycle.

Budget 2026 in One Line

Budget 2026 is not loud, but it is deeply focused on getting the systems right, rewarding the compliant, building infrastructure, and preparing India’s youth for a rapidly evolving job market.

For businesses, this means tighter compliance frameworks, digital-first operations, and a renewed focus on transparency and timely execution. Platforms like HR HUB are now more critical than ever, helping organizations manage employee records, statutory compliance, PF/ESI deadlines, payroll processing, and onboarding in line with the government's evolving expectations.

Whether it's managing TDS deductions, automating payroll-linked tax adjustments, or tracking revised PF/ESI deposit timelines, HR HUB enables companies to stay aligned with Budget 2026’s vision, a modern, compliant, and future-ready India.