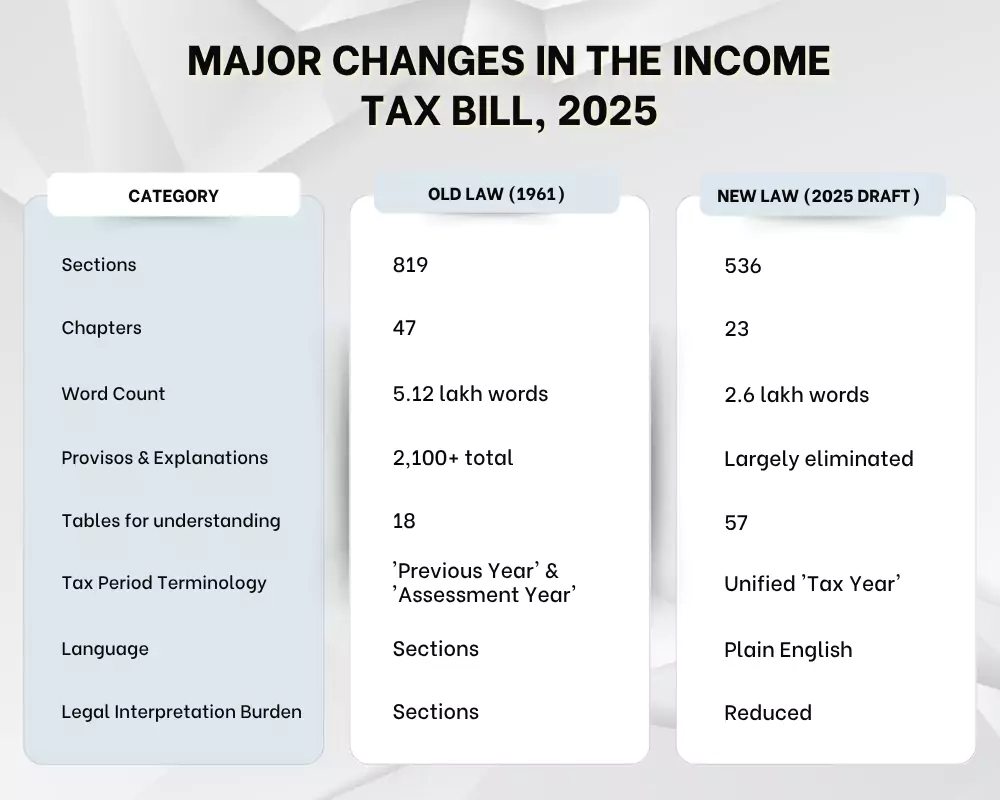

India is on the verge of a historic shift in its income tax framework. The government has introduced the Income Tax Bill, 2025, aiming to replace the Income Tax Act of 1961 — a six-decade-old law often criticized for its complexity and legal jargon.

This new bill is not just about fewer sections or simplified language — it represents a broader attempt to modernize India's tax landscape for digital-era taxpayers, small businesses, professionals, and investors alike.

Let’s break it down.

Why Was a New Income Tax Bill Needed?

Over the years, the Income Tax Act, 1961, has become cluttered with frequent amendments, confusing clauses, and various court interpretations. It led to:

- Over 1,200 provisos and 900+ explanations that often contradicted each other

- Increasing legal disputes and compliance burden

- A significant gap between tax laws and modern economic realities like digital business, global transactions, and startup income

The government recognized the need for a complete overhaul rather than a piecemeal update. Thus came the Income Tax Bill, 2025, designed to be:

- Concise

- Easy to interpret

- More transparent

- Aligned with global best practices

Key Concept: ‘Tax Year’ Instead of ‘Assessment Year’

This is one of the most fundamental shifts in the new bill.

Current system:

- You earn income in one financial year

- You pay tax and file returns in the next financial year, called the “assessment year.”

Proposed system:

- The term “Tax Year” will replace both

- You’ll earn and pay tax in the same year.

This move:

- Reduces confusion for first-time filers

- Aligns with international standards

- Simplifies compliance for individuals and salaried professionals

Who Benefits: Stakeholder-Wise Breakdown

The Income Tax Bill, 2025, isn’t just a structural revamp — it brings tangible improvements for various types of taxpayers. Here's how it helps each group:

Salaried Individuals

If you’re earning a monthly salary, the new bill aims to make your tax journey less stressful and more transparent:

- Simpler ITR forms: Filing your tax returns will become faster and easier, with fewer fields to fill and clearer language.

- Straightforward deductions and exemptions: You’ll see a precise list of what you can claim—like standard deduction, HRA, or investments—without jumping between sections or deciphering legal jargon.

- No more “Assessment Year” confusion: Since taxes will now be calculated and filed in the same Tax Year, you won’t need to figure out which financial year you’re reporting for.

Bottom line: Easier tax filing, better clarity, and reduced dependency on tax consultants for basic filing.

Freelancers & Professionals

For doctors, designers, consultants, and other self-employed individuals, estimating tax liability can be tricky. This bill makes it easier:

- Unified and cleaner terminology: No more navigating between complex definitions of “business income” vs “professional income” vs “other sources.”

- Plain-language tables for tax liability: You'll get straightforward charts to determine how much you owe based on your income and deductions.

- Better guidance on advance tax & presumptive taxation: The rules for paying tax in installments or opting for simplified tax schemes (such as 44ADA) are now clearer and more logical.

Bottom line: Smarter tax planning, fewer mistakes, and greater confidence in handling taxes independently.

Small Businesses & Startups

Small enterprises and digital-first startups often struggle with audit norms, TDS rules, and the complexity of filing. The bill introduces a business-friendly approach:

- Simplified TDS (Tax Deducted at Source) & TCS (Tax Collected at Source): Fewer categories, clearer thresholds, and simplified compliance.

- Streamlined audits and documentation: Smaller firms may be eligible for more lenient thresholds and better-defined audit requirements, thereby reducing CA dependency.

- Better clarity on digital income: Whether it's income from online platforms, digital subscriptions, or capital raised through investors, there’s a clearer framework for taxation.

Bottom line: Lower compliance burden and reduced ambiguity for small business owners and startup founders.

Investors

Whether you’re dabbling in mutual funds or serious about long-term capital gains, the new bill helps you stay compliant without a headache:

- More precise capital gains rules: The categories for long-term and short-term investments, indexation, and exemption clauses are better structured, making it easier to plan investments.

- Easier reporting of income from assets: Returns from shares, real estate, crypto (if applicable), or dividends come with clear instructions on how to report them.

- Less paperwork: Documentation and declaration formats are expected to be simplified, encouraging honest disclosures without the fear of penalties due to form errors.

Bottom line: Transparent taxation leads to better investment decisions and less fear of mismatches during scrutiny.

NGOs & Not-for-Profits

Charitable institutions often find themselves entangled in confusing exemption rules. This bill brings them clarity and consistency:

- Straightforward registration norms: The criteria for securing or renewing registration under tax-exempt categories are now better defined.

- Structured exemptions: There’s less ambiguity around what donations qualify, how funds must be used, and what disclosures are required.

- Simplified compliance tracking: The revised system is expected to enable NGOs to allocate more resources to their core mission and spend less on legal advisors.

Bottom line: Better compliance = fewer rejections, smoother audits, and stronger donor trust.

Legal Simplification = Fewer Court Disputes

One of the biggest flaws in the old tax system was the excessive interpretation. Lawyers, accountants, and even judges spent years debating how to apply or interpret certain provisions.

Why was this happening?

- Provisos contradicting main clauses: A clause might say one thing, while its proviso might say another.

- Notifications overriding original law: Updates were often made through circulars or press notes—leading to confusion about what was valid.

- Too many explanations: With over 900 explanations, each provision had a ‘but’, ‘if’, or ‘unless’ attached—leading to conflicting meanings.

What the 2025 Bill does right:

- Removes 1,200+ provisos and 900+ explanations

- Introduces plain language rules and visual tables

- Clearly defines when a new provision applies and when it doesn’t

Result?

Taxpayers won’t need to fear audits based on legal misinterpretations, and tax professionals will spend less time decoding the law and more time helping clients stay compliant.

Greater Transparency: Exemptions, Deductions & Rates

One of the key demands from taxpayers has always been: “Tell us exactly what we can claim and how.” The 2025 Bill answers that with a transparent structure:

- Well-defined slabs and rates: Tax brackets and income levels are laid out cleanly, with fewer overlaps or conditional rates.

- Dedicated chapters: Deductions (such as health insurance, home loan interest, and donations), TDS/TCS, and various income sources are now organized into separate, easy-to-navigate chapters.

- Clarity on tax-saving provisions: While the popular “Section 80C to 80U” system may be renamed or restructured, the new model promises easier eligibility tracking and documentation.

Why it matters: Middle-class taxpayers and young earners often miss out on savings simply due to poor visibility. This bill empowers them with information they can use.

Current Status in Parliament

- The Monsoon Session of Parliament (July 21 to Aug 21) is where this bill is expected to be discussed.

- The Standing Committee on Finance has already submitted 285 suggestions, which were reviewed before the final draft was tabulated.

- Once approved by the Lok Sabha and Rajya Sabha, the new law could come into effect from FY 2026–27

What’s Next?

If passed:

- New rules will likely be notified in 2026

- CBDT (Central Board of Direct Taxes) will issue simplified ITR forms

- A nationwide awareness campaign will likely follow to educate citizens on the new system.

Final Takeaway

The Income Tax Bill, 2025, is not just an amendment — it’s a complete reset of how India approaches personal and business taxation.

While we await final passage, this draft gives a strong indication of the future of tax governance: one that’s clearer, faster, and taxpayer-friendly.

For honest taxpayers, this could mean less stress, more predictability, and a smoother experience every April. And for such interesting and amazing informative videos, feel free to reach out to HR HUB’s Tax-Ually Employee Series.