You may have read many articles on India’s new GST slabs, but here we’ll make it simple and easy—what the reform means, why it’s happening, and how it could affect you.

Since its rollout in July 2017, the Goods and Services Tax (GST) has steadily replaced India’s fragmented indirect tax system with a unified framework.

In mid-2025, the Prime Minister’s Office (PMO) and the Group of Ministers (GoM) endorsed a proposal to scrap the 12% and 28% slabs. The GST Council is set to meet in early September 2025, with changes expected by Diwali 2025.

What’s the Proposed Change?

On 15th August 2025, the government outlined three pillars for next-gen GST reforms: structural changes, rate rationalisation, and ease of doing business.

What this means compared to the old system:

- The 12% slab (≈19% of items) will disappear. Goods here will either become cheaper (shifted to 5%) or costlier (shifted to 18%).

- The 28% slab (≈3% of items) will also go. Around 90% of these items will move to 18%, while only ultra-luxury and sin goods like high-end cars, liquor, and cigarettes will fall under the new 40% rate.

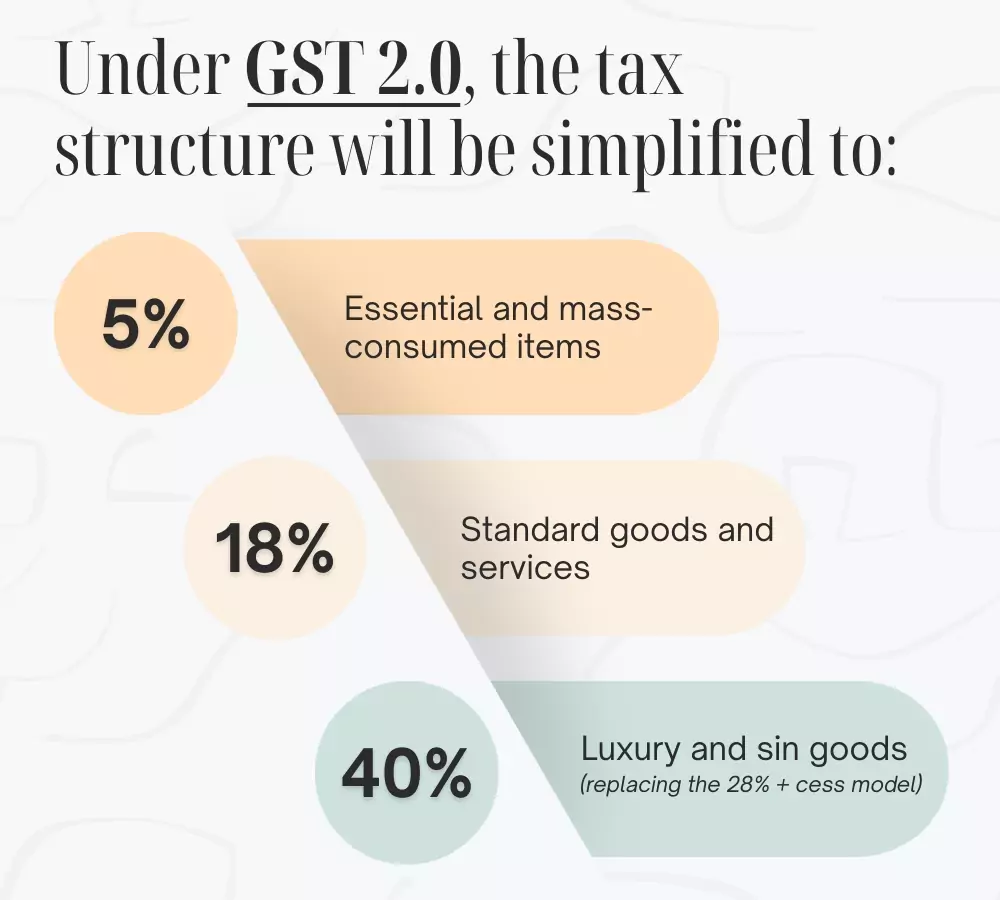

In short, India is moving from a five-slab system (0%, 5%, 12%, 18%, 28%) to a leaner three-slab structure (5%, 18%, 40%), making GST simpler and easier to manage.

Which Items Will Be Affected—and How Prices May Change

The removal of the 12% and 28% slabs means many common products will see a price shift:

Everyday consumer goods & essentials

- Packaged snacks and foods: tooth powder, bhujia, namkeen, ketchup, jam, mayonnaise, packaged juices, pasta, noodles, butter, condensed milk, ghee, cheese, milk-based beverages

- Grocery & daily-use staples: ghee, butter, packaged foods, fruit juices, packaged coconut water

- Personal care items: soaps, hair oil, toothpaste

- Health & hygiene: medicines, vaccines, HIV/TB diagnostic kits, Ayurvedic remedies

Appliances, gadgets & utilities

- Mobile phones, computers, sewing machines, pressure cookers, geysers, non-electric water filters, irons, vacuum cleaners

- Ready-made garments above ₹1,000 & footwear priced ₹500–₹1,000

Education, home & miscellaneous

- Bicycles, cookware, utensils, exercise books, geometry boxes, maps, globes, solar water heaters, agricultural machinery, prefabricated buildings, vending machines, glazed tiles

Broader categories: All food items, textiles, cement, salon & beauty services, individual life & health insurance plans may also shift to 5% GST.

Total coverage: ~99% of items currently in the 12% slab are expected to move to this 5% bracket.

Items Moving to 18% GST (from 28%)

- Small cars and two-wheelers under 250 cc

- Home appliances & white goods: Air conditioners, televisions, refrigerators, washing machines, dishwashers, railway AC units

- Construction & infrastructure: Cement and ready-mix concrete

- Insurance premiums (health & life), possibly even down to nil in some cases

About 90% of items from the 28% slab are expected to downshift to 18% GST.

For consumers, this means everyday essentials may become cheaper, while electronics, clothing, and luxury products could see a price hike.

What’s the Timeline?

Until the GST Council approves the change and officially notifies it, the existing tax structure remains unchanged.

- September 3–4, 2025 – GST Council meeting in New Delhi to approve the proposal.

- Navratri–Diwali 2025 – Expected rollout of new GST slab structure.

- FY 2026–27 onwards – Businesses to fully align with the simplified framework.

Final Thoughts

The upcoming removal of the 12% GST slab (and rationalization of the 28% slab) is not just a tax tweak—it’s a historic restructuring of India’s indirect tax regime.

If passed, it could:

- Simplify compliance and filings

- Boost India’s ease-of-doing-business ranking

- Rebalance consumption through cheaper essentials and costlier luxuries

- Temporarily dent government revenue but strengthen long-term efficiency

For now, the reform awaits formal GST Council approval—but all signs point toward a leaner, three-slab GST regime by Diwali 2025, shaping how every Indian business and household interacts with taxation.

At HR HUB, we keep businesses ahead of such regulatory changes with smart tools for tax management, payroll, and compliance, ensuring smooth transitions even during big reforms like GST 2.0.