The Government of India has announced a Next-Gen GST Reform, effective from September 22, simplifying taxes and reducing costs on essential items, healthcare, education, automobiles, and electronics. It’s a historic Diwali gift for the nation.

This reform is aimed at easing the cost of living and supporting both households and businesses. Here’s a clear breakdown of all items with their old vs. new GST rates.

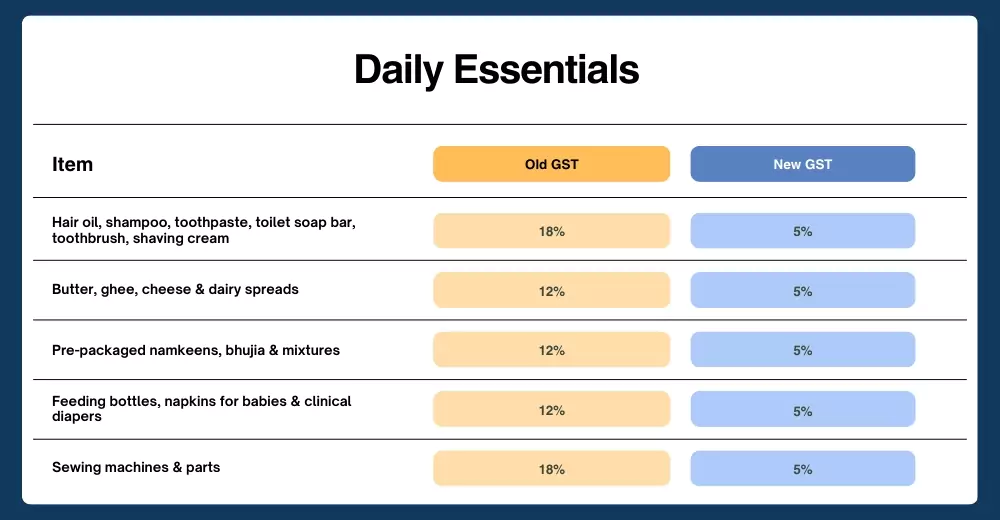

1. Daily Essentials

Everyday household items now attract lower GST, reducing the burden on families.

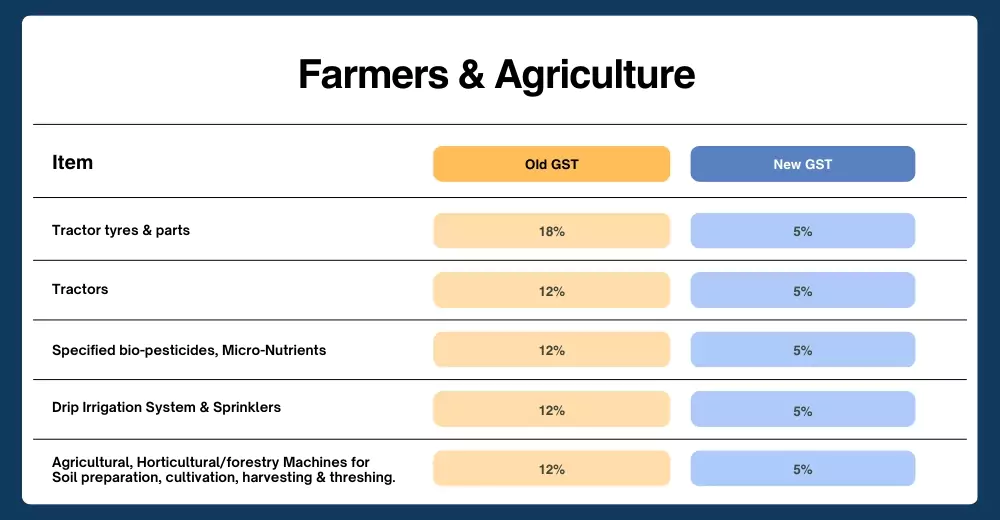

2. Farmers & Agriculture

Farming tools and equipment are cheaper, helping farmers cut costs in cultivation and irrigation.

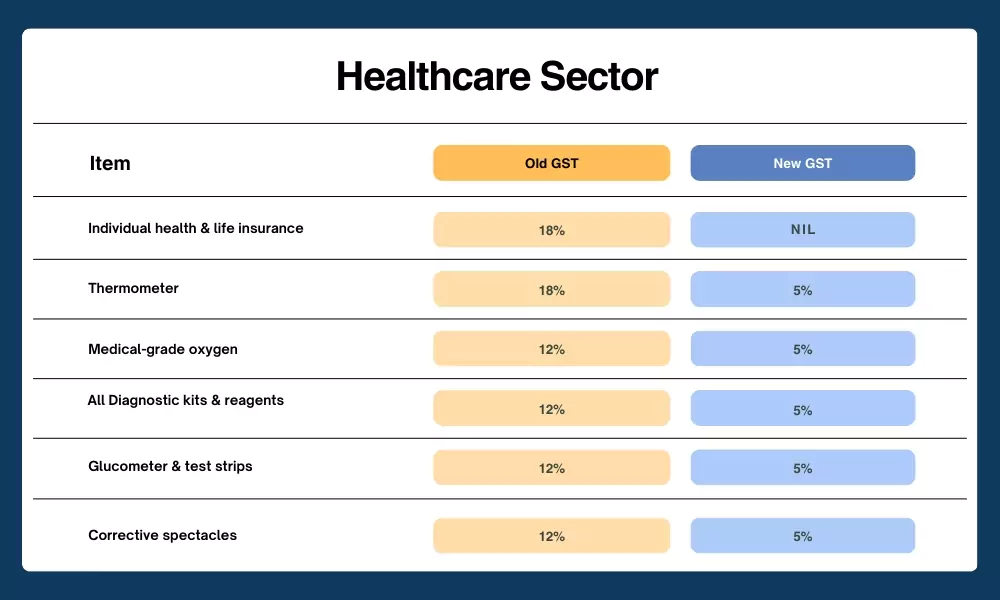

3. Healthcare Sector

Healthcare items and services have seen major cuts, making treatment and diagnosis more affordable.

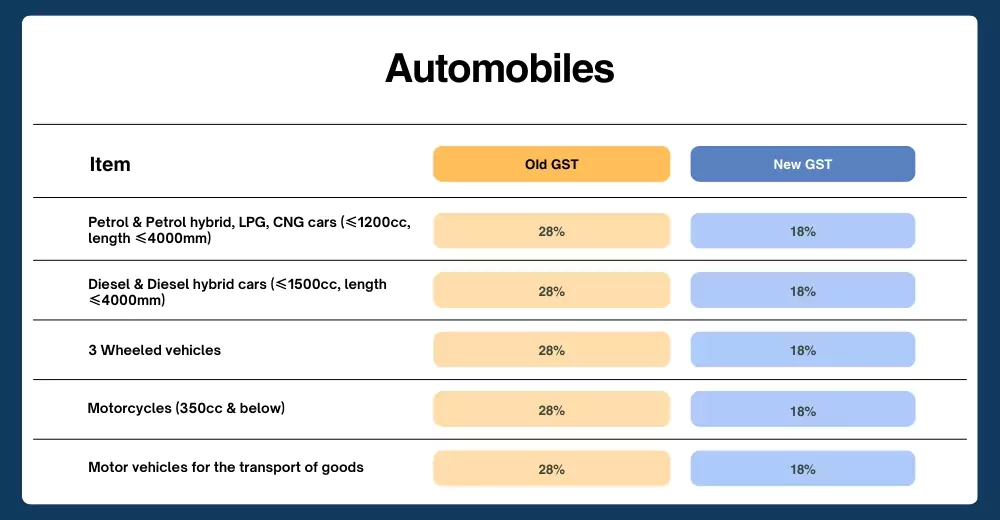

4. Automobiles

Vehicles for families and businesses have become more affordable with reduced GST rates.

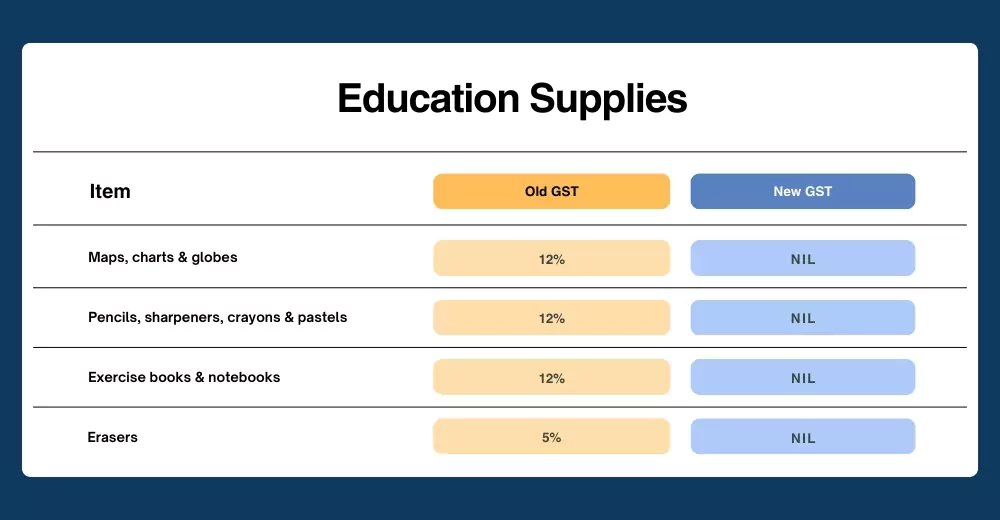

5. Education Supplies

School and study essentials are now either tax-free or much cheaper for students.

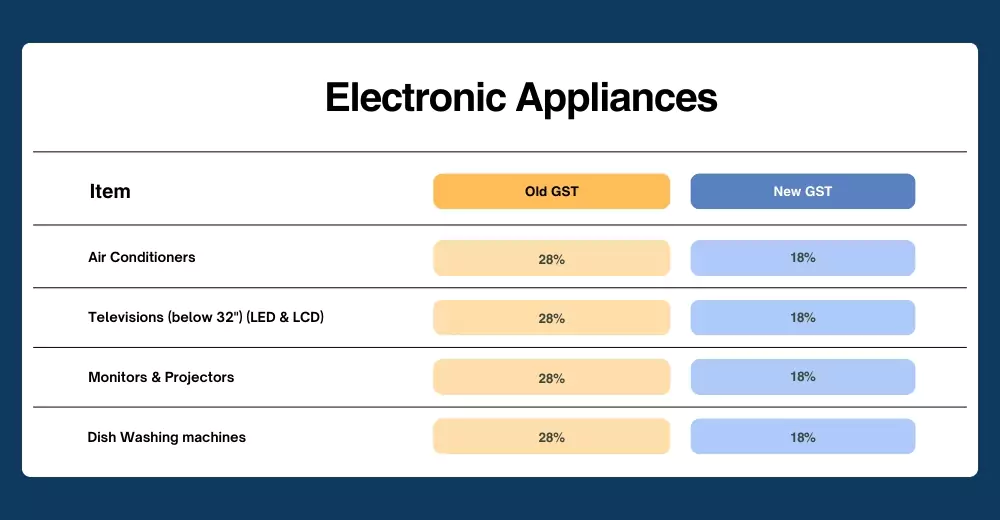

6. Electronic Appliances

Household appliances have seen a tax cut, making durable goods more accessible.

7. GST Process Reforms

Along with reduced GST rates, the government has simplified registration and refund procedures, making compliance smoother for businesses.

Registration

- Automatic registration within 3 working days for applicants.

- Applicants are identified by the system based on data analysis.

- Eligible applicants are those who determine that their Input Tax Credit will not exceed ₹2.5 lakh per month and opt for the scheme.

Refund

- The proper officer will sanction provisional refunds through system-based risk evaluation.

- Refunds will be applicable for:

- Zero-rated supplies (exports, SEZs, etc.)

- Supplies under an inverted duty structure (when tax on inputs is higher than on outputs).

Final Takeaway

The Next-Gen GST Reform reduces the cost of essential goods, healthcare items, education materials, vehicles, and electronics. It makes everyday living more affordable while also supporting farmers and businesses.

From household groceries and school supplies to farming machinery and consumer electronics — this reform impacts nearly every sector and promises real savings for the people.

For businesses, especially HR and finance teams, compliance with changing tax rules is just as important as the rate cuts themselves. Platforms like HR HUB already integrate GST and payroll compliance features, helping organizations stay updated, automate calculations, and ensure error-free filings. This means companies can not only pass the benefits of reduced costs to employees but also stay compliant with ease.