Let’s face it—running a small business often feels like spinning 12 plates at once. You're handling customers, tracking inventory, managing vendors, hiring people, and oh, paying them too. And that’s where it gets tricky.

Payroll is one of those deceptively simple tasks. “Just pay them on time,” they say. But behind that paycheck is a maze of tax rules, compliance deadlines, salary structures, and sensitive data. And in 2025, one misstep could cost more than just a late fee—it could cost your employees’ trust.

Enter the unsung hero of modern business growth: payroll software for small companies. Not just any tool, but the kind that understands your constraints, fits your team size, and doesn’t drown you in a sea of corporate features meant for enterprises.

Let’s decode exactly what you—a small but mighty business owner—should look for in a payroll solution this year.

Outgrowing Spreadsheets? That’s a Sign

If Excel is still doing your payroll heavy lifting, it’s time to talk. Manual calculations are like open wires in your workflow—prone to shocks, sparks, and shutdowns.

But here's the thing: you don’t need a complex enterprise system. What you need is software for payroll for small business—a lean, clean, and compliant tool that fits like a glove, not a suit three sizes too big.

2025 has brought smarter options, affordable automation, and cloud-native solutions tailor-made for businesses like yours. Let’s explore what features matter most.

1. Compliance That Works in the Background—So You Don’t Have To

Let’s begin with the most misunderstood part of payroll: compliance. For many small businesses, it’s a silent risk. One missed deadline or wrong calculation, and suddenly you’re facing notices, penalties, or a payroll investigation.

However, here's the good news: with the right payroll software for small companies, compliance can become a silent strength rather than a constant stressor.

What to Look For:

- Automatic tax engine updates The system should track real-time changes in income tax rules (like changes in new regime slab limits), professional tax slabs across states, PF/ESIC thresholds, and surcharge rates—so you don’t have to Google every quarter.

- Auto-generated statutory forms A robust solution should produce Form 16, Form 12BA, Form 24Q, monthly ECR (Electronic Challan cum Return) files, and state-wise PT challans. No more manual templates or filling outdated formats.

- Multi-state compliance If you have employees across Karnataka, Maharashtra, and Gujarat, for example, your software should intelligently apply relevant state rules without requiring you to manage each state's compliance separately.

- Compliance calendar with smart nudges Look for tools that send reminders—not just for PF and TDS dates, but also investment proof collection, tax declaration deadlines, gratuity eligibility windows, and bonus payments.

- Audit-ready logs You should be able to pull historical payroll changes, who processed which salary revision, and which proof was approved or rejected.

Compliance mistakes don’t just attract penalties—they chip away at your team’s trust. Employees begin to worry when PF isn’t deposited or TDS isn’t updated in their 26AS. A smart payroll system takes the weight off your shoulders and builds long-term confidence—internally and externally.

2. A Dashboard That Speaks Your Language

Let’s be honest—payroll software isn’t just for finance pros anymore. It’s for owners, HR generalists, office managers, and sometimes even the founders themselves. And that’s why design and usability are no longer optional—they're deal breakers.

The old-school systems, with complicated grids and cryptic codes, make you feel like you're defusing a bomb. You shouldn’t need a training session just to process pay.

What to Look For:

- Contextual task flows Instead of throwing 20 buttons at you, the software should guide you: “Start Payroll → Review Attendance → Apply Deductions → Confirm and Disburse.” A clean, sequenced flow is everything.

- Clear visibility of status You should know what’s processed, pending, or stuck—at a glance. Use cases like: “5 employees pending TDS declaration,” “Salary on hold for 2 due to attendance error,” etc.

- Visual insights Integrated charts showing payroll costs, tax liabilities, headcount trends, and leave impact help you connect the dots in one place.

- Built-in microguides Features like “What is this?” tooltips, embedded help articles, or a chatbot that explains payroll jargon can save hours and boost confidence for first-time users.

A truly modern payroll dashboard doesn’t just execute tasks—it supports decision-making. It puts you in control of payroll without forcing you to become a payroll expert.

3. Flexibility for Modern Workplaces—Not Just Desk Jobs

Your workplace in 2025 probably includes more than just salaried employees. Think:

- Remote full-timers

- Hourly workers

- Sales teams on commission

- Interns or freelancers

- Staff with split shifts or multiple roles

Payroll software should be able to handle all of this complexity without turning into chaos.

What to Look For

- Dynamic salary structures You should be able to create multiple templates—basic + HRA, performance-based bonus, fixed + incentive—and assign them to a specific role or person. No more one-size-fits-all.

- Multiple payroll groups For businesses that pay factory workers weekly and office staff monthly, the software must allow simultaneous payroll cycles with distinct rules.

- Smart attendance rules Flexibility in attendance syncing: If someone works 3 hours a day for 6 days, the system should calculate pay based on the exact person-hours, rather than applying the default monthly salary logic.

- Integration with gig/freelance payout structures Some tools also allow linking to task-based payroll, ideal for service-based businesses that use contractual workers.

As workforce models evolve, rigid systems only create bottlenecks. The best payroll software for small businesses doesn’t restrict you—it evolves with your business model.

4. Integration Isn’t Optional—It’s Essential

Think of payroll as the final piece of a puzzle. But if the pieces don’t align—like leave, attendance, timesheets, finance—you’ll end up fixing problems you didn’t cause.

What to Look For:

- API-based integrations Whether it’s connecting to HRMS modules, your CRM for performance data, or even a biometric device at your reception, your system should allow easy plug-ins.

- Sync with finance/accounting tools. Once payroll is processed, the system should auto-sync salary entries, tax payments, and reimbursements to your accounting software with proper journal entries.

- Live attendance sync Daily attendance logs, punch-in/punch-out times, and even location-based attendance (for remote teams) should automatically feed into payroll logic.

- Expense claim integration Travel, mobile, or internet reimbursements should be processed through payroll with minimal intervention.

An integrated system not only saves time, but it also saves trust and prevents salary disputes. You should focus on your team, not on troubleshooting salary calculations every month.

5. Data Privacy & Role-Based Access: Because Trust Is Everything

Your payroll system holds incredibly sensitive data—think about it: bank accounts, PAN numbers, salary revisions, loan recoveries, medical reimbursements, family info. In an era of increasing data breaches, even small businesses are vulnerable targets.

What to Look For:

- Granular permission levels The finance team views payment-related data, HR views leave and benefits, and managers view team-wise data. All others see only what’s meant for them.

- Encryption and access logs All data must be encrypted using AES-256, and system access must be logged and timestamped. If someone edits an employee’s CTC, you should know who, when, and why.

- Restricted IP access For extra-sensitive operations, such as bonus processing or final settlements, enable access only from company networks or trusted IP addresses.

- Auto session expiry & anti-screen capture measures These are underrated features that reduce risk in a shared-device environment.

Trust is invisible—but the moment it breaks, it’s game over. A secure payroll system maintains employee confidence while minimizing legal issues.

6. Self-Service That’s Useful

Your employees shouldn’t have to send six emails to get one payslip. In 2025, the expectation is clear: access everything digitally, immediately, and independently.

What to Look For:

- Mobile-friendly employee portal Employees should be able to view/download payslips, check tax deductions, and raise queries from their phone, without apps crashing or experiencing a clunky user experience.

- Tax planning visibility Show employees how much tax they’ve saved so far and let them upload Section 80C/80D documents with real-time validations.

- Investment proof workflows Admins should be able to approve/reject proofs with comments, and employees should get timely updates to resubmit.

- Notifications and alerts Set up smart alerts for things like: “Form 16 is ready,” “Declare investments before March 10,” “Tax exceeded by ₹12,000 this month.”

Self-service isn’t about reducing your workload alone—it’s about giving employees control and visibility over their money, which directly boosts morale and reduces queries.

7. Support That’s Not Just a Chatbot

Software is only as good as the help you get when it doesn’t work as expected, especially during critical windows, such as salary day, TDS filing deadlines, or appraisal seasons.

What to Look For:

- Dedicated account manager (if possible) For businesses with unique payroll setups, having a go-to human saves hours of explanation.

- Ticketing + chat support hybrid Immediate issues need chat. Technical queries may need ticket-based resolution. The system should offer both.

- Support knowledge base with videos, FAQs, and walkthroughs. Especially important when onboarding new HR staff or implementing internal process changes.

- SLA-based support response Look for guaranteed timelines (e.g., 2 hours for critical payroll issues) instead of vague “we’ll get back to you soon.”

Even the best systems glitch. The real value lies in how quickly they help you recover, with minimal damage to your workflow or reputation.

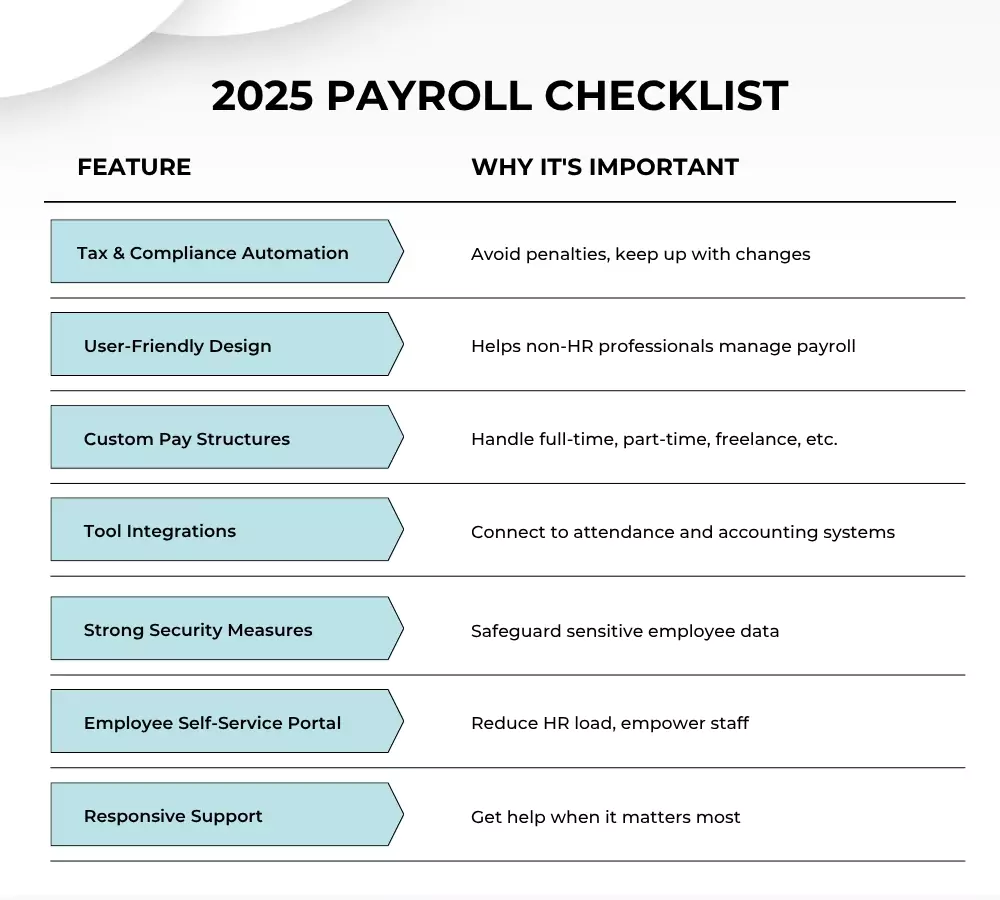

Your 2025 Payroll Toolkit: A Quick Checklist

Before you choose your platform, ensure it checks all these boxes:

Powering Your Small Business Payroll with Confidence: HR HUB Has You Covered

Choosing the right payroll software isn’t just a business decision—it’s a leadership one. It tells your employees: I value you enough to get this right. And it tells you: I’m ready to build with confidence.

That’s exactly what HR HUB is built for. Whether you’re a 10-member startup or a 150-member fast-scaling business, HR HUB is your trusted partner in:

- Running payroll with zero guesswork

- Automating statutory compliance in real-time

- Offering built-in attendance, leave, and performance sync

- Empowering employees with self-service and digital records

- Scaling with you—no matter how fast you grow

More than just software, HR HUB is your payroll command center—smart, compliant, and built for real-world teams.

So, don’t wait for another payroll month to pass in stress. Switch to a system that lets you lead with clarity and pay with confidence.

Curious to see it in action? Let’s schedule a demo customized to meet your business needs. Because payroll peace of mind isn’t just for the big guys—it’s for small businesses like yours, too.