When people think of work in India, salary is often the first factor that comes to mind. Yet, the financial story of employment goes much deeper than just the monthly paycheck.

A significant part of an employee’s overall compensation consists of benefits that provide security, reward loyalty, and foster confidence in the future.

Among these, the Employees’ Provident Fund (EPF) and Gratuity stand out as two of the most meaningful pillars.

Both are designed to safeguard long-term well-being, yet they often feel complicated due to the use of technical jargon and layers of regulations. The good news is that, with the right explanation, these benefits can be easily understood and appreciated.

Understanding Employee Benefits in India

Employee benefits in India can be broadly divided into two categories: mandatory and voluntary.

Mandatory benefits are those that employers are legally obliged to provide, such as EPF, Gratuity, health insurance under the Employees’ State Insurance (ESI) Act, and maternity benefits. These are not optional; they are rights secured by law. On the other hand, voluntary benefits encompass all the additional perks that companies offer, including meal cards, family health coverage, wellness allowances, and learning opportunities.

The mandatory benefits are the backbone of social security in India, ensuring that employees are not left vulnerable in times of retirement, medical needs, or career transitions. EPF and Gratuity form the most recognised components in this set, and understanding them is crucial for every employee.

EPF: The Foundation of Employee Security

The Employees’ Provident Fund is perhaps the most familiar employee benefit in India. Managed by the EPFO, this system serves as a long-term savings plan, where both the employer and employee contribute a portion of their monthly salary.

How it works

- Employee contribution: Typically 12% of the basic salary.

- Employer contribution: Also 12%, although part of this amount is allocated to the Employee Pension Scheme and the Employee Deposit Linked Insurance scheme.

- Interest: The contribution grows with annual interest declared by the EPFO, typically at a rate of around 8%.

Over time, this builds into a substantial corpus that employees can fall back on after retirement or during career breaks.

Benefits for employees The EPF is not just retirement money. It also allows for partial withdrawals for specific needs, such as purchasing a home, addressing medical emergencies, funding education, or covering the costs of marriage. This makes it more flexible than a savings account, as it serves as both a retirement tool and a support system for important milestones.

Withdrawal rules An employee can withdraw the entire amount upon retirement or if unemployed for more than two months. Partial EPF withdrawals are permitted under conditions such as illness, home construction, or higher education. This process is generally referred to as making an EPFO claim.

Why it matters Many employees in India may not prioritise retirement planning in their early years of work. EPF addresses this issue by fostering a culture of saving. Each contribution, along with the employer’s share, creates a habit of building security without active effort from the employee.

To make this even easier, tools like the HR HUB EPF Calculator help employees instantly estimate how much their savings can grow over time. By entering simple details, such as basic salary and contribution percentage, employees can clearly see their projected balance and plan their financial future with greater confidence.

Gratuity: A Reward for Loyalty

Gratuity is different from EPF in both spirit and execution. While EPF is a savings pool built over time, Gratuity is a one-time benefit paid by the employer as a gesture of gratitude for long service.

Eligibility Employees become eligible for Gratuity after completing a minimum of five years of continuous service with the same employer. There are exceptions in cases of death or disability, where gratuity is paid even if the employee has not completed the required five years of service.

Calculation The formula is simple yet powerful:

Gratuity = (Last drawn salary X 15 X Years of Service) ÷ 26

Here, the last drawn salary refers to the Basic Salary plus the Dearness Allowance. The “15” represents 15 days of wages for every completed year of service, while 26 reflects the average working days in a month.

Example Consider an employee with a basic salary of ₹20,000 who has worked for 10 years. The gratuity would be calculated as: 20,000 × 15 × 10 ÷ 26 = ₹1,15,385.

This amount is paid at the end of service, acting as a financial cushion and an acknowledgement of loyalty.

Importance For employees, gratuity is often the first significant lump sum they receive in addition to their regular salary. It helps bridge the gap between employment periods, supports family needs, or strengthens retirement savings. For employers, it creates an incentive for employees to stay longer, improving retention.

To simplify the process, employees can use the HR HUB Gratuity Calculator. By entering salary details and years of service, they can instantly view their estimated gratuity amount and plan for the financial support they will receive upon retirement.

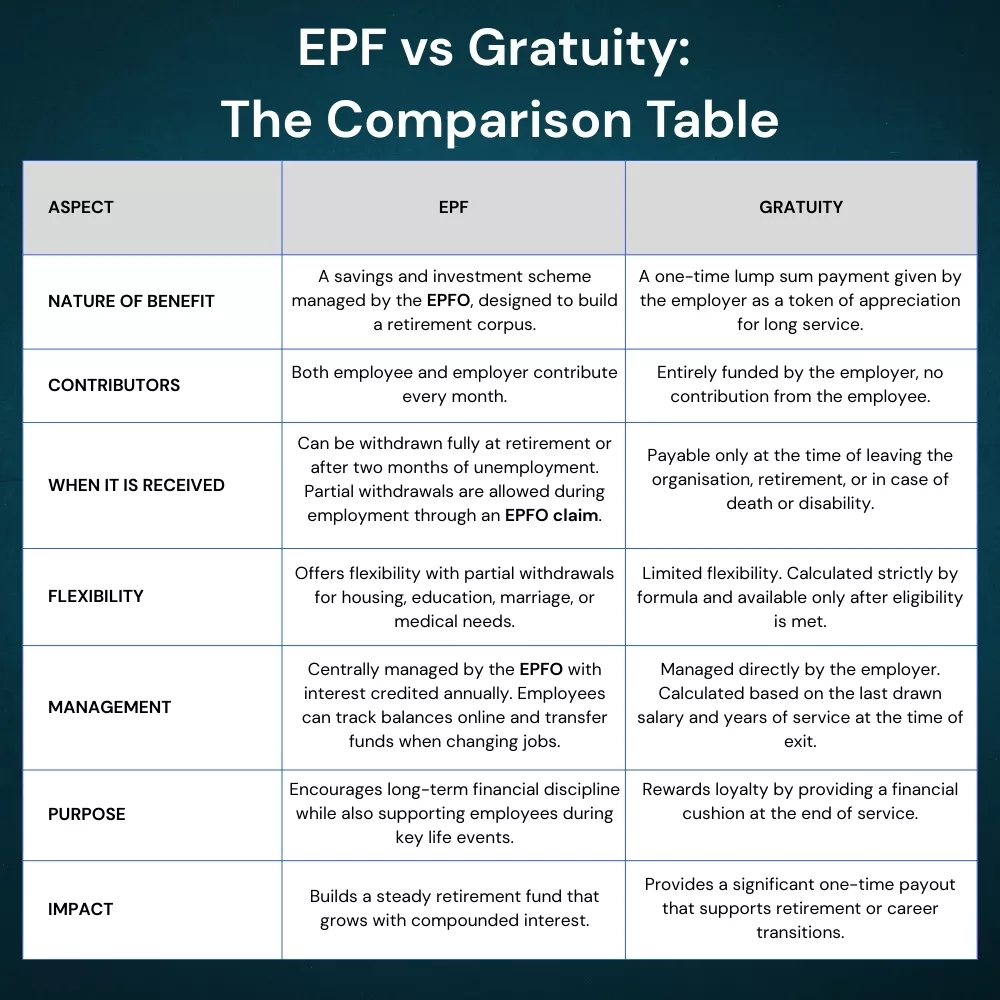

While both benefits may seem similar at first glance, this comparison shows that EPF and Gratuity serve very different purposes in an employee’s financial journey.

EPF builds security step by step through regular contributions and government oversight, while Gratuity delivers a meaningful lump sum at the end of long service.

Together, they complement each other: one nurturing disciplined savings over time, the other rewarding loyalty with a financial send-off. Employees who understand this balance are better equipped to plan their careers and long-term financial goals.

Building Confidence Through Employee Benefits

EPF and Gratuity form the backbone of financial security for employees in India. While EPF, managed by the EPFO, builds long-term savings, Gratuity rewards loyalty with a meaningful payout. Understanding both helps employees plan with confidence.

With HR HUB, organisations can simplify EPF contributions, Gratuity calculations, and EPFO claims through automated compliance and transparent dashboards, ensuring employees see the true value of their benefits.