Tax Doesn’t Have to Be Tedious—Let’s Make It Make Sense

You work hard, earn a living, and then—boom—tax season hits. You’re handed a maze of numbers, deductions, and jargon. Ever wondered, “Am I doing this right?” Or “Is there an easier way?”

Good news: income tax calculation isn’t a mystery—it’s a method. Once you understand tax slabs and use the right tools, you can go from tax-stressed to tax-savvy.

And if you're looking for a simple, accurate, and employee-friendly tool, check out the free HR HUB Income Tax Calculator It’s designed to help you calculate your taxes in seconds—whether you follow the old regime, the new one, or just want to compare both.

Let’s now decode how tax slabs work—and how to make them work for you.

Two Roads, One Destination: Tax Clarity

India’s tax system gives you a choice:

- Old Tax Regime – Higher rates, but loaded with exemptions and deductions.

- New Tax Regime – Lower rates, but minimal to no deductions allowed.

It’s like choosing between a full-course meal with a long prep time (Old Regime) or a quick, ready-to-eat option that saves time but skips the extras (New Regime). The best way to choose? Use a reliable income tax calculator to run the numbers.

New Tax Regime: Simple, Streamlined, and Default

Introduced to simplify tax filing, the New Regime is now the default option unless you actively opt for the old one. The tax rates under the new structure are designed to offer lower percentages—but without allowing most of the common deductions.

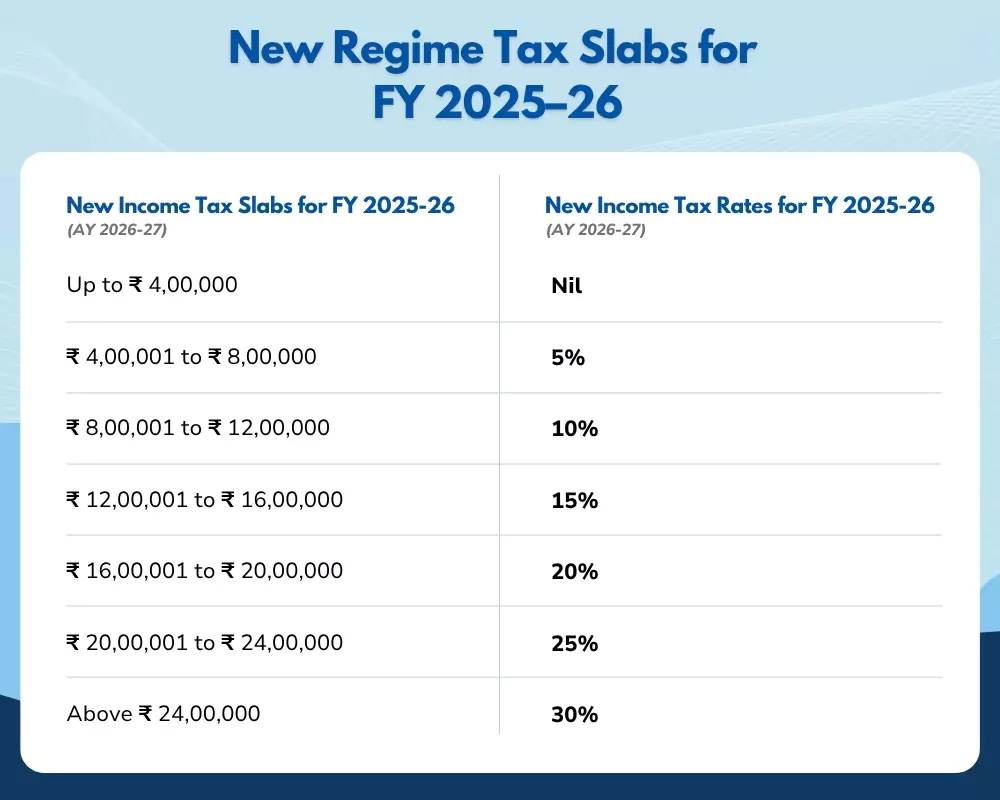

New Regime Tax Slabs for FY 2025–26

Standard Deduction: ₹50,000

Section 87A Rebate: If your income after deductions is ≤ ₹7,00,000, you pay zero tax

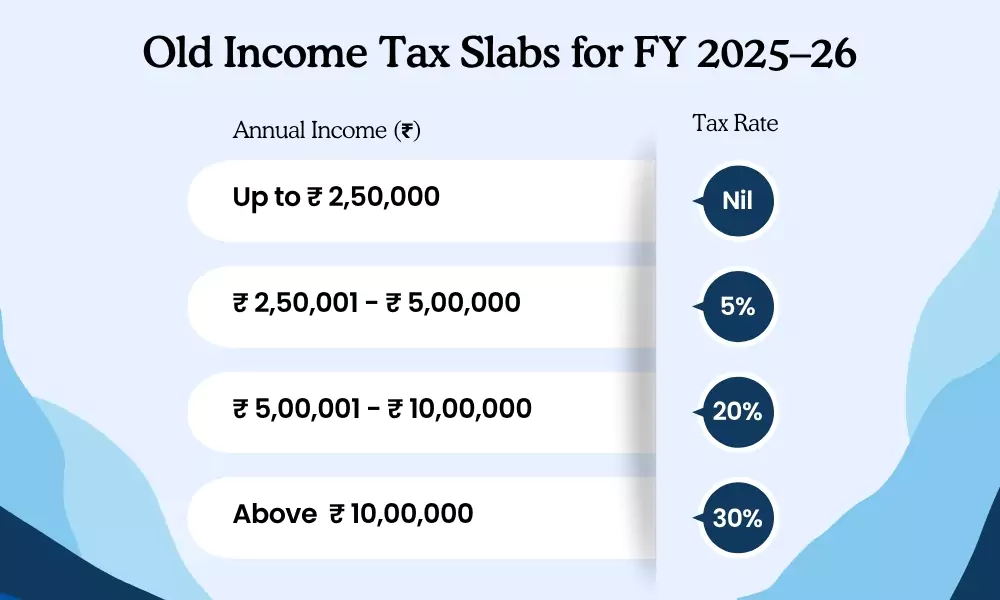

Old Tax Regime: The Classic Approach (With Perks)

Prefer a little effort in exchange for tax-saving options? The Old Regime might still be for you. It supports deductions like:

- ₹1.5 lakh under Section 80C (PPF, ELSS, LIC)

- ₹25,000–₹75,000 under 80D (Health Insurance)

- HRA, LTA, education loan interest, and more

Old Income Tax Slabs for FY 2025–26

Before you dive into the examples of understanding the difference between new regime and old regime, it’s important to understand basic difference between them. Watch the video here: https://www.youtube.com/shorts/BuPyLHOKieM

Example: New Regime vs. Old Regime in Action

Let’s say your annual salary is ₹15,00,000. Here’s how it plays out under both regimes:

Under New Regime

- Gross Income: ₹15,00,000

- Standard Deduction: ₹50,000

- Taxable: ₹14,50,000

Now let’s apply the slabs:

- Up to ₹4,00,000 → Nil

- ₹4L–₹8L = ₹4,00,000 @ 5% = ₹20,000

- ₹8L–₹12L = ₹4,00,000 @ 10% = ₹40,000

- ₹12L–₹14.5L = ₹2,50,000 @ 15% = ₹37,500

Total Tax = ₹97,500 Cess @ 4% = ₹3,900 Final Tax = ₹1,01,400

Under Old Regime

Let’s assume you claim:

- ₹1.5L under 80C

- ₹25,000 under 80D

- ₹1L HRA

Total Deductions = ₹2,75,000

Taxable Income = ₹15,00,000 – ₹2,75,000 = ₹12,25,000

Apply slabs:

- ₹2.5L–₹5L = ₹2.5L @ 5% = ₹12,500

- ₹5L–₹10L = ₹5L @ 20% = ₹1,00,000

- ₹10L–₹12.25L = ₹2.25L @ 30% = ₹67,500

- Total Tax = ₹1,80,000

- Cess @ 4% = ₹7,200

So in this case, the New Regime saves you ₹85,800—but only because deductions under Old were limited. If you can claim more, the balance can shift.

This is where a smart income tax calculator really shines. One input. Two outputs. Big clarity.

How to Choose Your Regime Like a Pro

Pick the New Regime if:

- You don’t have many deductions to claim

- You want simplicity

- Your income is under ₹7 lakh

Pick the Old Regime if:

- You invest, pay rent, or have a home loan

- You actively claim deductions

- You want to customize your tax-saving plan

Still confused? Use an income tax return calculator that compares both regimes. Many government portals and fintech apps offer this feature free.

Don’t Just File—Understand and Optimize

Taxes are inevitable. Overpaying is not. Whether you’re a salaried employee, a consultant, or part of a growing team, understanding the slab system helps you stop guessing and start planning.

But here’s the smarter move: take the guesswork out altogether.

HR HUB provides your organization with a built-in income tax calculator, declaration workflow, and preview system—enabling employees to plan better, declare faster, and file smarter. From regime selection to proof submission and payroll sync, it’s your tax-season command center.

- No confusion.

- No last-minute Excel sheets.

- Just clarity—backed by compliance.

Your Tax, Your Rules—Just Smarter

Calculating tax doesn’t have to feel like a pop quiz. With the right understanding of slabs, a reliable online tax calculator, and tools like HR HUB, you’ve got everything you need to take control.

Now that you know the numbers, the only question is—Old regime or New?